Why Multi-manager investing

Multi-Manager fund managers take the hard work out of fund selection by researching, selecting and monitoring funds and then blending them together in a diversified portfolio.

Multi-manager

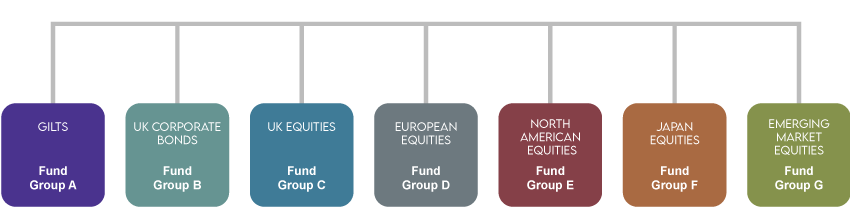

Actively managed multi-manager solutions are a type of investment whereby the portfolio manager invests in a range of underlying funds run by fund managers from different investment companies. These are selected across a range of asset classes and investment styles to build an efficient portfolio.

The role of the manager of a multi-manager portfolio is similar to that of the Chair of a company’s Board of Directors, in that they select and manage the executives (fund managers) who they believe will deliver the best performance in their allocated role.

Where the multi-manager portfolio manager believes conditions are right, they can change strategy and substitute the funds or fund managers within different sectors. They do this in order to make the portfolio more efficient and, depending upon prevailing market conditions, they can adopt a more aggressive or defensive approach.

Multi-manager portfolios are designed to take the worry out of deciding how and where to invest as the manager picks a range of funds in different regions and asset types to suit the current market environment.

Active management

Active management involves direct input and influence by a fund manager over the mix of asset classes within a portfolio. Decisions are taken to buy, sell or hold investments depending on their specific characteristics and how they fit within current geopolitical, economic and market conditions.

This is the opposite to passive investing, where a portfolio is structured to passively follow a particular investment index, regardless of the merits of individual securities.

Based upon extensive experience and data to support their decisions, active fund managers aim to predict how markets and sectors are likely to react and will take positions within portfolios to reflect their views.