Achieving the right mix

No-one can predict which will be the best asset class each year. Different asset classes will perform differently as the market changes — today’s winner may be tomorrow’s loser.

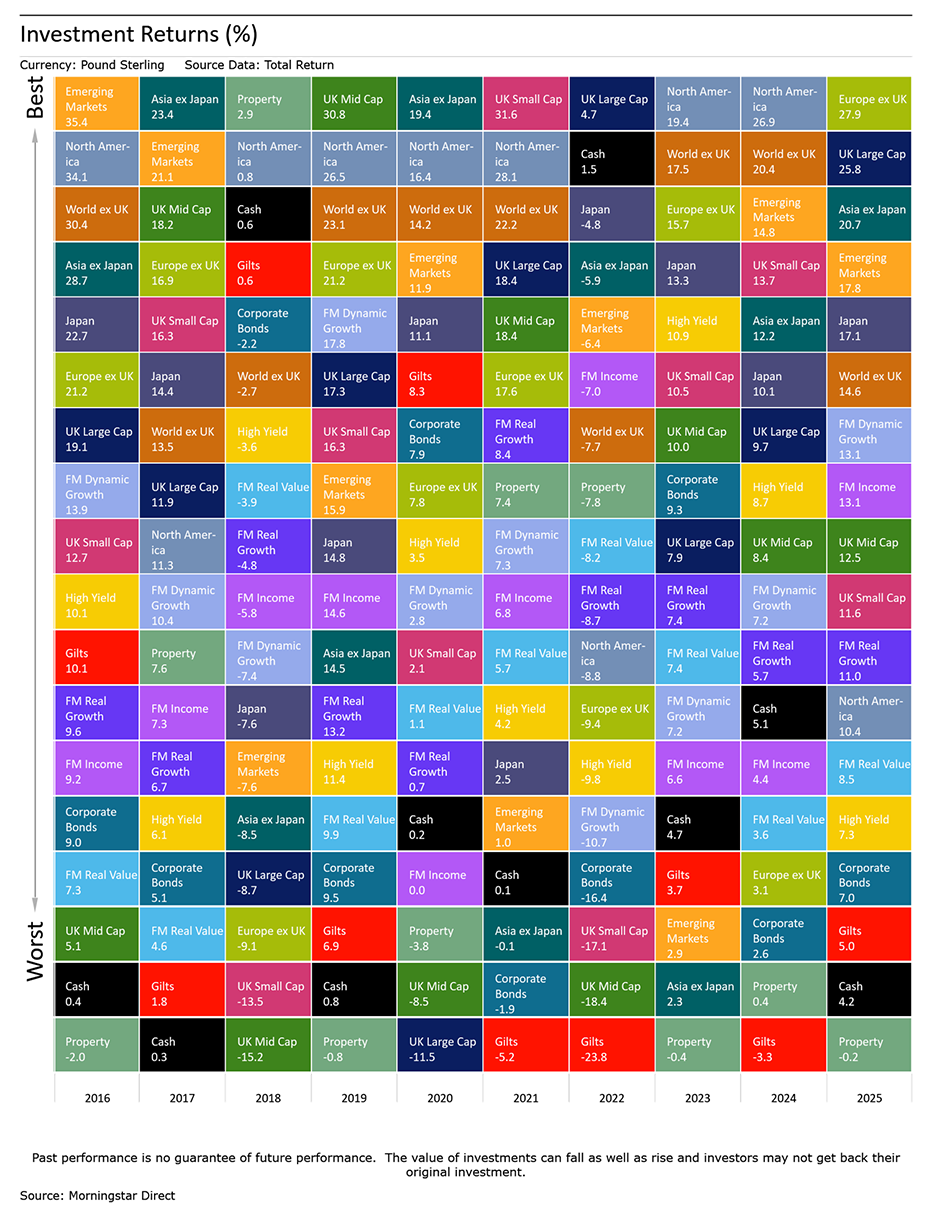

The mosaic table shows the performance of individual asset classes and the four Future Money funds over the past ten years. This highlights the variability in returns amongst asset classes over time and how the Future Money solutions have performed by investing across major asset classes. It shows how we can help minimise losses as well as grow your money.

The table also shows the risk created by taking investment decisions based on past performance.

Taking UK small cap equities, for example, this is a higher risk asset class that may drive strong returns one year, yet may be a large detractor the next. For instance, an investor in 2022 may have been attracted to the strong gains achieved by the sector in 2021 and could have hoped for a continuation of this strength.

However with valuations stretched, 2022 delivered a very poor performance for the sector, with smaller UK companies delivering amongst the worst returns across investment markets.

This shows the importance of taking investment decisions based on thorough analysis, but also the importance of building diversified portfolios. Exposure to multiple asset classes helps smooth out the volatility of the current winners and losers. What’s more, with professional management, an investment portfolio can be adjusted to deliver exposure which remains appropriate as conditions change.

The structure of multi-manager portfolios allows specialist investment funds to be used in every part of your portfolio while providing investment exposure which is well balanced across geographical and stylistic allocations.

The aim of this focus on specific expertise and diversification is to maximise investment returns while minimising the level of risk.